Fixed compensation

The Chairman of the Management Board receives fixed compensation in consideration for his role.

The gross annual fixed compensation of Arthur Sadoun as Chairman of the Management Board of Publicis Groupe S.A. amounted to 1,170,000 euros per year since January 1, 2022.

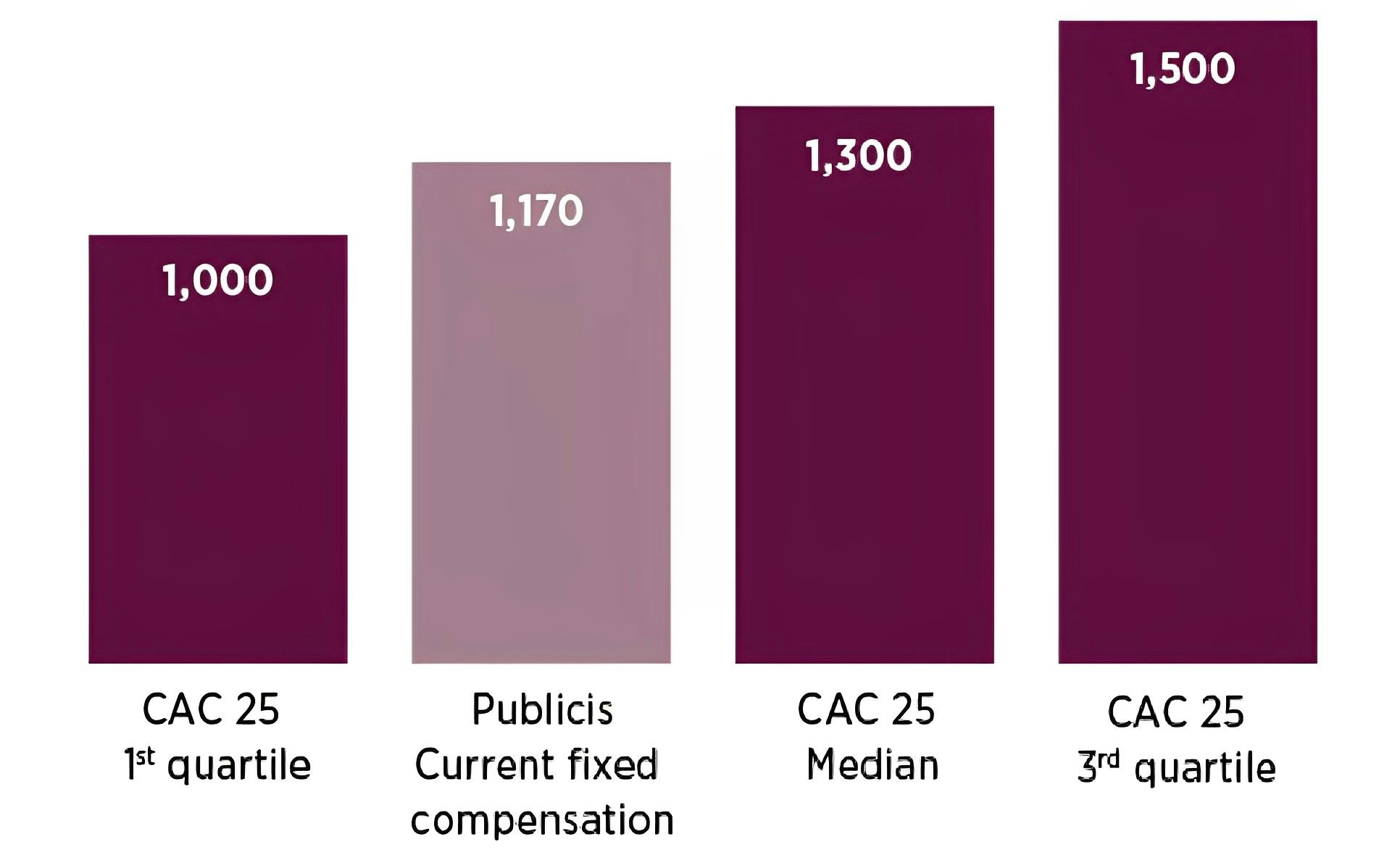

The analysis of Arthur Sadoun’s fixed compensation in comparison with that of his peers in the CAC 25(1) (as illustrated below) as well as that of the executives of Publicis Groupe’s main competitors, i.e. WPP, Omnicom and IPG, shows that, his fixed compensation remains below the median of the CAC 25 and that of the Groupe of comparable companies (i.e. WPP, Omnicom and IPG).

It is proposed to be left unchanged.

This graphic represents the analysis of Arthur Sadoun’s fixed compensation in comparison with that of his peers in the CAC 25.

CAC 25 1st quartile: 1,000

Publicis Current fixed compensation: 1,170

CAC 25 Median: 1,300

CAC 25 3rd quartile: 1,500

Annual variable compensation

Given the uncertain economic situation, it became clear on the Supervisory Board that the variable part of Arthur Sadoun’s compensation should be more rewarding in case of good performance and more penalizing in the event of underperformance. Thus, the objectives were set in scales (between scales, on a proportional basis):

- If the first scale was not reached, the corresponding portion of the annual variable compensation would be zero

- At the first scale, the corresponding portion of the annual variable compensation would be 80%

- At the second scale, the corresponding portion of the annual variable compensation would be 100%

- If the third scale is reached or exceeded, the corresponding portion of the annual variable compensation would be 150%.

Thus, the annual variable compensation, the target of which is 200% of the annual fixed compensation, may be 300% in the best case. A contrario in case of underperformance, the annual variable compensation would be significantly negatively impacted and could be zero.

On the recommendation of the Compensation Committee, the Supervisory Board adopted stringent performance criteria to determine the variable compensation of Arthur Sadoun, which for the 2023 financial year, are based on:

- Two financial criteria accounting for 80% of the overall weighting of the criteria, i.e. organic growth of the Groupe’s revenue and the Groupe’s operating margin.

- These absolute criteria were chosen by the Supervisory Board, following the proposal of the Compensation Committee, because they are demanding and best express the quality of the Company’s performance. These criteria provide an incentive to overperform, since variable compensation may be increased if the objectives are exceeded, with however a cap of 50% on each of these two criteria.

- The option to compensate overperformance is aligned with the Groupe’s mechanisms for annual variable compensation.

- A non-financial quantifiable individual criterion of 20% of the overall weighting based on Corporate Social Responsibility (CSR). To accelerate the achievement of our CSR commitments, the variable compensation in respect of this criterion could be increased by 50% if the objectives are exceeded and reach the next year’s indicative checkpoint one year early.

If all the criteria are achieved and the margin and growth objectives are exceeded, as well as those for CSR commitments, Arthur Sadoun’s annual variable compensation may represent a maximum of 150% of his target annual variable compensation, i.e. 300% of his annual fixed compensation.

All these criteria, set in advance, are quantified and based on measurable objectives that are made public, with the exception of those that are of a strategic and confidential nature. All these criteria are proposed by the Compensation Committee and validated by the Supervisory Board.

The Committee assesses, in the finest detail, the performance for each objective and each criteria.

(1) The companies selected for the reference Group (CAC 25) are Air Liquide, Alstom, Bouygues, Capgemini, Carrefour, Danone, Dassault Systèmes,Engie, Essilor Luxottica, Kering, Legrand, L’Oréal, LVMH, Orange, Pernod Ricard, Renault, Safran, Saint Gobain, Sanofi, Schneider Electric,Teleperformance, TotalEnergies, Veolia, Vinci and Vivendi. This panel of companies was defined by excluding financial services, Groupes based abroad, small Groupes, companies where the compensation policy is influenced by the State and companies with specific governance.