MICHEL-ALAIN PROCH

Annual variable compensation target for 2022

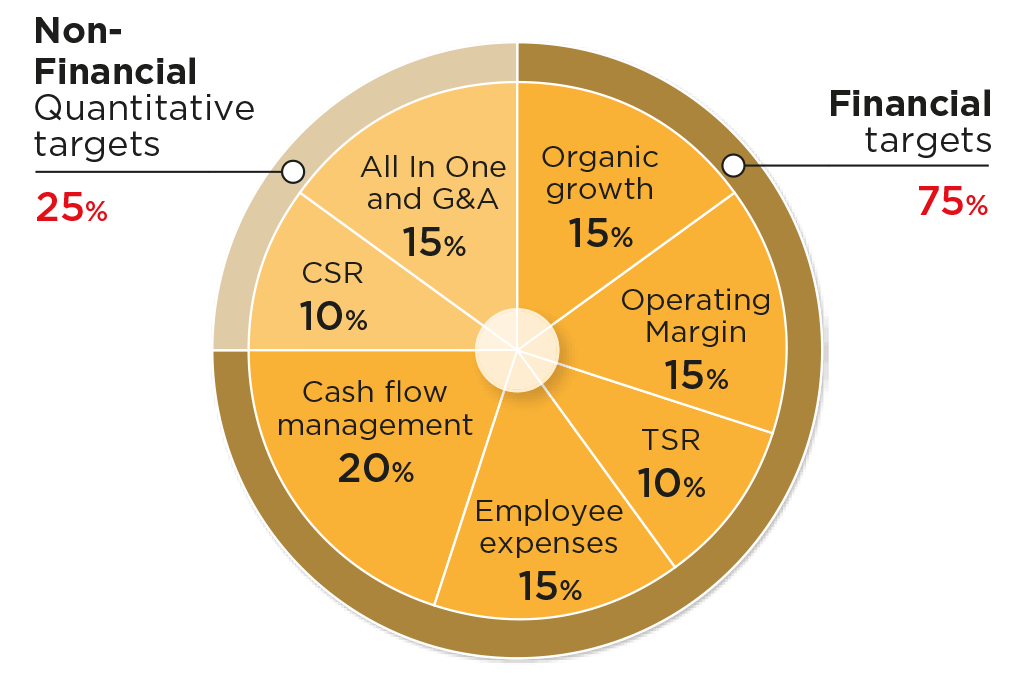

Quantitative targets Non Financial : 25 %

CSR : 10 %

All In One and G&A : 15 %

Financial Targets : 75 %

Organic growth : 15 %

Marge opérationnelle : 15 %

TSR : 10 %

Employee expenses : 15 %

Cash flow management : 20 %

Long-term variable share-based compensation

Publicis Groupe decided to set up a share plan each year for management and certain key employees of the Groupe. As a member of the Management Board, Michel-Alain Proch is eligible for this plan since 2021. Under this plan, the number of shares that may be delivered at the end of a three-year vesting period (except in the event of death or disability), i.e. in March 2024 for the “LTIP 2021 Directoire” and March 2025 for the “LTIP 2022 Members of the Directoire” plan, will depend – for 90% of the shares awarded – on Publicis Groupe’s average financial performance over a three-year period (2021-2023 for the “LTIP 2021 Directoire” plan and 2022-2024 for the “LTIP 2022 Members of the Directoire” plan) as compared with the financial performance of a peer group comprising WPP, Omnicom, IPG and Publicis Groupe, plus two conditions relating to Corporate Social Responsibility for 10% of the shares awarded.

Assuming the performance conditions are met, entitlement to receive shares is subject to continued employment until the end of the vesting period. Details of these plans are presented in Section 3.2.1.4.

In the event of forced departure or a departure due to a change in control or strategy and except in the event of serious or gross misconduct, shares awarded may be retained prorata temporis, pursuant to a reasoned decision of the Supervisory Board and subject to performance conditions.

In the event of retirement, he may, at the end of the vesting period and upon a decision of the Supervisory Board, in accordance with the compensation policy approved by shareholders and applicable at that time, receive the shares granted to him prorata temporis.

Benefits in kind

The use of one of the Company cars.

Moreover, Michel-Alain Proch is covered by the job-loss insurance taken out by Publicis Groupe for its corporate officers, as the French unemployment office (Pôle Emploi) does not cover this.

Collective health and welfare insurance and pension plans

Michel-Alain Proch benefits from the coverage applicable to executives under the French regime. Michel-Alain Proch may benefit from the PERECO and PER O plans open, subject to conditions, toall Groupe employees in France with an employment contract.

Employment contract

Michel-Alain Proch has an employment contract with one of the Groupe’s subsidiaries.

Severance payment

The current commitments to Michel-Alain Proch provide that in the event of a forced departure due to a change in control or strategy and other than in the case of serious or gross misconduct, Michel-Alain Proch would be entitled to a severance payment.

Provided that Michel-Alain Proch does not continue to be employed by Publicis Groupe, the amount of the severance would be equal to one year’s total gross compensation (fixed and variable compensation paid), calculated using the average of the last 24 months of compensation.

He would also have the right to exercise the options to subscribe to and/or to purchase the shares that have been awarded to him, and to retain the performance shares already granted to him prorata temporis, subject to the performance conditions set out in the regulations for the plan in question.

In addition, the payment of the severance amount would be subject to a performance condition: the severance amount would only be due in its full amount if the average annual amount of the variable compensation acquired by Michel-Alain Proch for the three years prior to the termination of his duties is equal to at least 75% of his “target variable compensation”. If the average annual amount is less than 25% of the “target variable compensation”, no sum or benefits will be due. If the average annual amount is between 25% and 75% of the “target variable compensation”, payments and benefits will be calculated on a proportional basis between 0% and 100% using the rule of three.

The severance payment may only be paid after the determination by the Supervisory Board that the performance conditions had been achieved at the date on which his term as a member of the Management Board ended.

The severance payment and any compensation in respect of the employment contract may not exceed two years of total compensation (fixed and variable compensation paid).