ARTHUR SADOUN

Annual variable compensation target for 2022

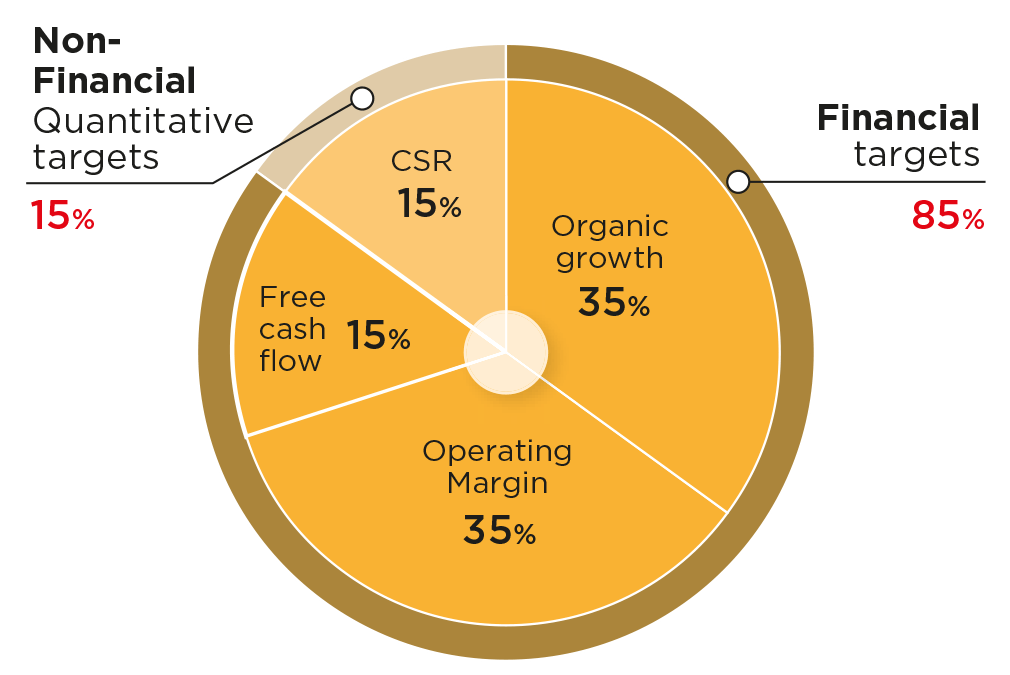

Non-Financial Quantitative targets: 15%

CSR : 15 %

Financial targets : 85%

Organic growth : 35%

Operating Margin : 35%

Free cash flow : 15%

Long-term variable share-based compensation

The Chairman of the Management Board receives annual variable share based compensation subject to the achievement of the objectives set as follows.

Publicis Groupe decided to set up a share plan each year for management and certain key employees of the Groupe. As Chairman of the Management Board, Arthur Sadoun is eligible for this plan since 2021. Under the “LTIP 2021 Directoire”, the number of shares that may be delivered at the end of a three-year vesting period (except in the event of death or disability), i.e. March 2024, will depend – for 90% of the shares awarded – on Publicis Groupe’s average financial performance over a three-year period (2021-2023), as compared with the financial performance of a peer group comprising WPP, Omnicom, IPG and Publicis Groupe, plus two conditions relating to Corporate Social Responsibility for 10% of the shares awarded.

From 2022, the number of shares that may be delivered at the end of a three-year vesting period (except in the event of death or disability), i.e. in 2025 under the "LTIP 2022 Président du Directoire”, will depend on:

- for 35% of the shares awarded, the organic growth compared to a peer group composed of Publicis Groupe and the other three main global communications groups, namely WPP, Omnicom and IPG over a three-year period (2022-2024),

- for 35% of the shares granted, the operating margin compared to a peer group composed of Publicis Groupe and the other three main global communications groups, namely WPP, Omnicom and IPG, over a three-year period (2022-2024),

- for 15% of the shares granted, the TSR (Total Shareholder Return) compared to the median of the CAC 40 over a three-year period (2022-2024),

- for 15% of the shares granted, conditions related to Corporate Social Responsibility and Talent management.

In addition, Arthur Sadoun is also a beneficiary of the LTIP 2019-2021 Directoire, whose shares will be delivered on June 14, 2022.P

In each of these plans, assuming the performance conditions are met, entitlement to receive shares is subject to continued employment until the end of the vesting period. Details of these plans are presented in Section 3.2.1.4.

In the event of forced departure or a departure due to a change in control or strategy and except in the event of serious or gross misconduct, shares awarded may be retained prorata temporis, subject to performance conditions.

In the event of retirement, he may, at the end of the vesting period and upon approval by the Supervisory Board, in accordance with the compensation policy approved by shareholders and applicable at that time, receive the shares granted to him prorata temporis.

Analysis of the compensation of Arthur Sadoun

Analysis of Arthur Sadoun’s compensation in comparison with that of his CAC 25(1) peers as well as with those of the top executives of Publicis Groupe’s main competitors, namely WPP, Omnicom and IPG, shows that, even after taking into account the increases likely to result from the adoption of the 2022 policy, the positioning of the maximum total compensation of Arthur Sadoun within the CAC 25 would remain unchanged (between the median and the third quartile) and would remain in last position compared to that of the main competitors. His overall compensation would thus remain in line with the philosophy adopted by the Compensation Committee and the Supervisory Board.

It should be noted that the Compensation Committee’s objective is not to align itself with variable compensation practices that are sometimes drastically different but to be able to objectively position the Groupe in relation to direct competitors.

Benefits in kind

Arthur Sadoun benefits from the use of a taxi firm and gets a refund for his taxis and entertainment expenses.

(1) The companies selected for the reference group (CAC 25) are Air Liquide, Alstom, Bouygues, Capgemini, Carrefour, Danone, Dassault Systèmes, Engie, EssilorLuxottica, Kering, Legrand, L'Oréal, LVMH, Orange, Pernod Ricard, Renault, Safran, Saint Gobain, Sanofi, Schneider Electric, Teleperformance, TotalEnergies, Veolia, Vinci and Vivendi. This panel of companies was defined by excluding financial services, groups based abroad, small groups, companies where the compensation policy is influenced by the State and companies with specific governance.